For companies and the self-employed facing liquidity problems as a result of the Corona crisis, the government decided on 3 April 2020 to increase the percentages of the benefits of the advance payments of the third and fourth due dates on 10 October and 20 December respectively. Thanks to this aid measure, the deferral of their advance payments is less disadvantageous.

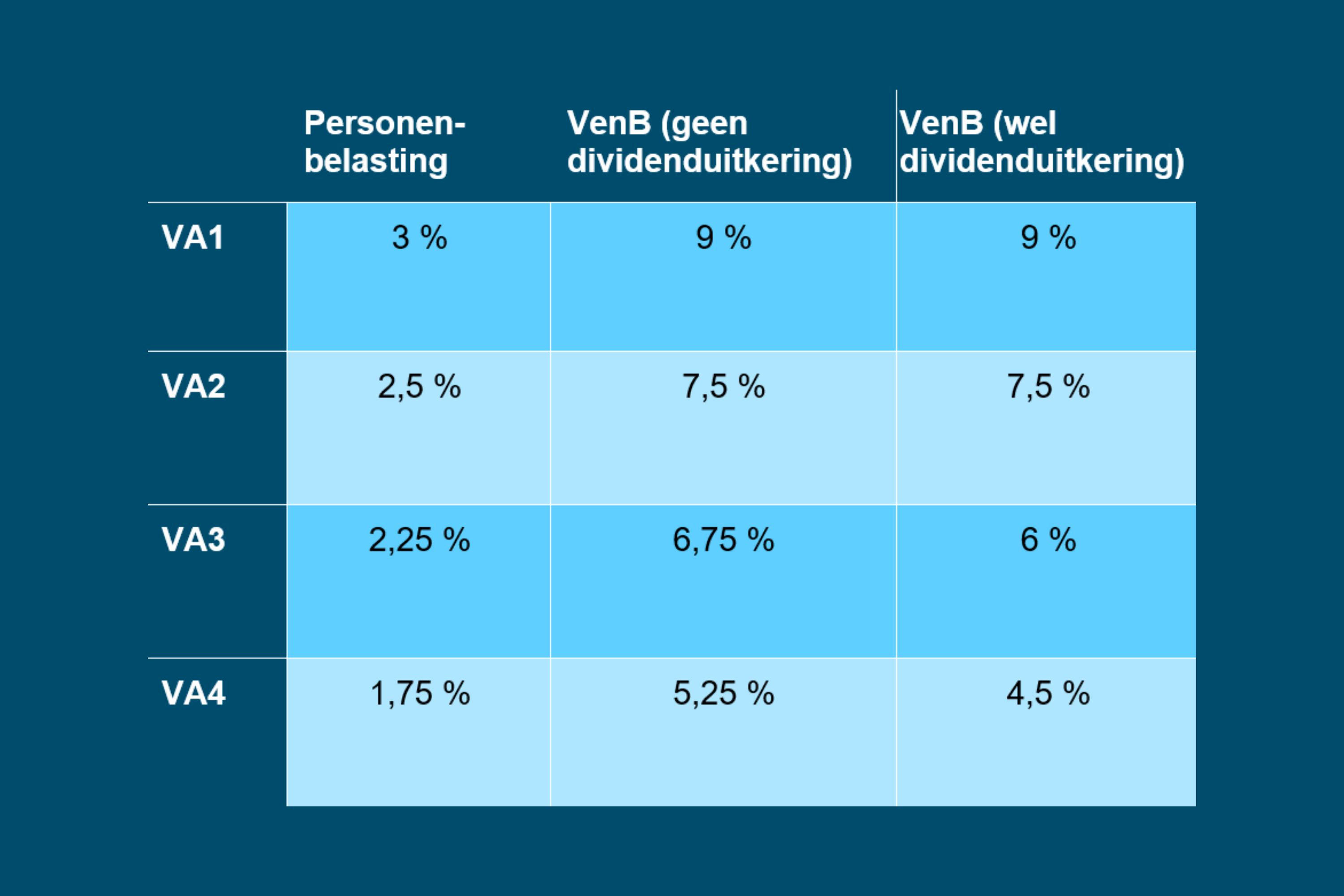

The table below shows the adjusted percentages for the advance payments. As mentioned above, these are higher in the third and fourth quarter (unless there is a dividend payment):

The measure is intended for companies with liquidity problems. Therefore, it does not apply to companies that:

- repurchase their own shares or make a capital reduction

- that pay or attribute dividends between 12 March 2020 and 31 December 2020

Two conditions are added to the 'postponement' of advance payments by the bill submitted at the end of April:

- an exception is made for companies that maintain contacts with tax havens. During the period from 12 March 2020 to the end of the year, they may not hold shares in or make payments to companies in a tax haven, unless they have real and existing commercial relationships.

- In addition, no bonus ("variable remuneration") may be granted to the chief executive officer or chairman of the executive board in the same period. The advance payment scheme applies to taxable periods ending between 30 September 2020 and 31 January 2021.

The increased percentages also do not apply to individuals who could receive more bonuses as a result of advance payments.

The percentages of the increases themselves remain unchanged, as do the dates of the advance payments.

If you have other questions regarding the Corona crisis, please visit our special FAQ

Last update: 26/05/2020