5 rules of thumb to make your company Corona-proof:

- Provide a contingency and business continuity plan;

- Discuss this plan during your HSE committee, works council and/or trade union delegation meetings;

- Provide your employees with information relating to basic hygiene rules and your Coronavirus plan;

- Set up arrangements concerning working from home and taking days off;

- Check your insurance policies;

- Check the agreements with / general terms and conditions of your main partners and suppliers to establish whether they contain force majeure clauses.

Preventive homeworking? The FPS Employment has confirmed that compulsory homeworking is permitted

Several banks are demanding that employees who have recently returned from a country at risk of contagion should work from home. Other companies have followed suit, e.g. by introducing an alternating shift pattern. Several experts argued that employers could not make this compulsory because the regulations pertaining to feasible and manageable work are based on voluntary work as a basic element. We beg to differ. As an employer you are indeed unilaterally changing the workplace by delegating someone to work from home. However, many employment contracts already include a so-called variability clause concerning the location of employment, on the basis of which an employer could impose a unilateral measure. Moreover, the Employment Contracts Act also contains an important stipulation in article 26, which covers force majeure. Article 26 states that a temporary suspension of the implementation of the employment contract does not result in termination of the employment contract.

Furthermore, as a "best practice employer", the employer must provide a healthy workplace (Article 20.2 Employment Contracts Act). This obligation obviously implies that non-infected employees are also entitled to a healthy workplace, which means that an employer can temporarily deny some employees access to the workplace because of a risk of infection. In accordance with Article 17.4, employees must also refrain from any activities that might compromise their own safety or the safety of their colleagues, their employer or third parties.

This reasoning is confirmed in a letter from the FPS Employment received on 11 March 2020, which clearly indicates that, in their role as best practice employer, an employer can indeed impose homeworking for all employees as a safety measure. To put it in a nutshell, compulsory homeworking is acceptable. It is advisable, however, to put any relevant agreements on paper and provide the necessary equipment such as a laptop and/or internet connection to facilitate homeworking.

In fact the World Health Organisation (WHO) specifically recommends working from home. For people who are returning from abroad, this global health watchdog also recommends monitoring for symptoms for 14 days and measuring your temperature twice a day.

Mandatory leave?

Can you force an employee to take leave of absence? In the absence of collective agreements, leave is the result of an individual agreement between employer and employee. However, article 63.2 of the Royal Decree dated 30 March 1967 stipulates that agreements are possible at company level and that in such cases these agreements have greater legal validity than individual negotiations. Rules can also be incorporated in the employment regulations concerning the taking of leave, which provides the option to include compulsory leave days. This requires compliance with the procedure for amendment of employment regulations, but hopefully employees and their representatives will appreciate the seriousness of the situation so that this proceeds smoothly. Time schedules can also temporarily be adjusted, which does not require an amendment of employment regulations, although the temporary amendment must be notified 24 hours in advance.

RVA (National Employment Office) and FPS acknowledge force majeure

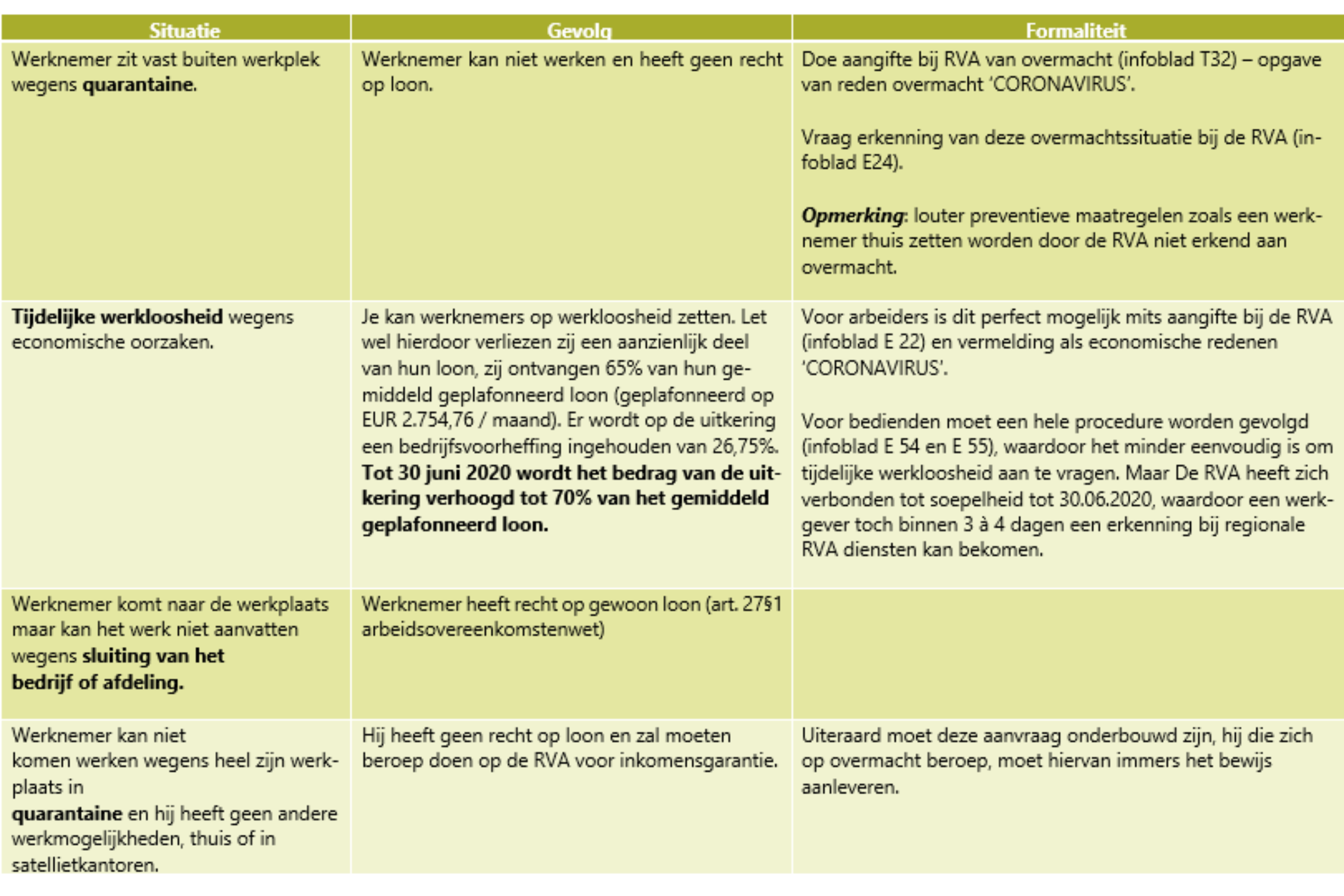

Both the FPS Employment and RVA have designated the Coronavirus as force majeure, initially until the end of March, but now until the end of June 2020. This is significant in the following situations:

Payment deferral?

Some companies may have temporary cash flow problems due to falling orders or because some of their customers are not paying on time. Buying ‘credit’ by not paying is tempting but also risky. It is advisable, therefore, to be proactive when making arrangements with customers and suppliers. Often the government (National Social Security Office, withholding tax, VAT, personal and corporation tax) will be one of your main creditors. The meeting of the Federal Council of Ministers dated 6 March 2020 decided that payments relating to these obligations to pay contributions and taxes can be staggered without incurring any fines or supplements. Remember though that the usual interest arrangements will remain in force, e.g. to the National Social Security Office (7% annually). They may also be cancelled subject to separate approval from the Management Committee, which you will usually only receive afterwards. Considerable differences in your operating account and treasury plan will act as proof of economic hardship vis-à-vis the NSSO. On this basis, you can submit an application to the NSSO at the latest by 30 June 2020 for a repayment plan of 12 to maximum 24 months. You will not be fined but whether or not interest will be charged still partly depends upon the goodwill of the NSSO.

Being an entrepreneur, it may consequently be more beneficial to talk to your bank, knowing that interest rates are still low, rather than taking on the government as a lender. Applications for these benefits must be submitted no later than 30.06.2020.

Bottom line?

Be prepared, Moore than ever! If ultimately there’s no need for all this, so much the better. If you do need it, you will at least have prepared relevant emergency scenarios.