1. The deferral for the filing of corporation tax, personal income tax and non-resident corporation tax returns from the 16 March to 30 April 2020.

You will have extra time until midnight on Thursday 30 April 2020 to file your corporation, legal entity and/or non-resident company tax return. This additional time limit only applies to returns with a deadline from 16 March up to and including 30 April 2020.

2. Deferral of VAT returns

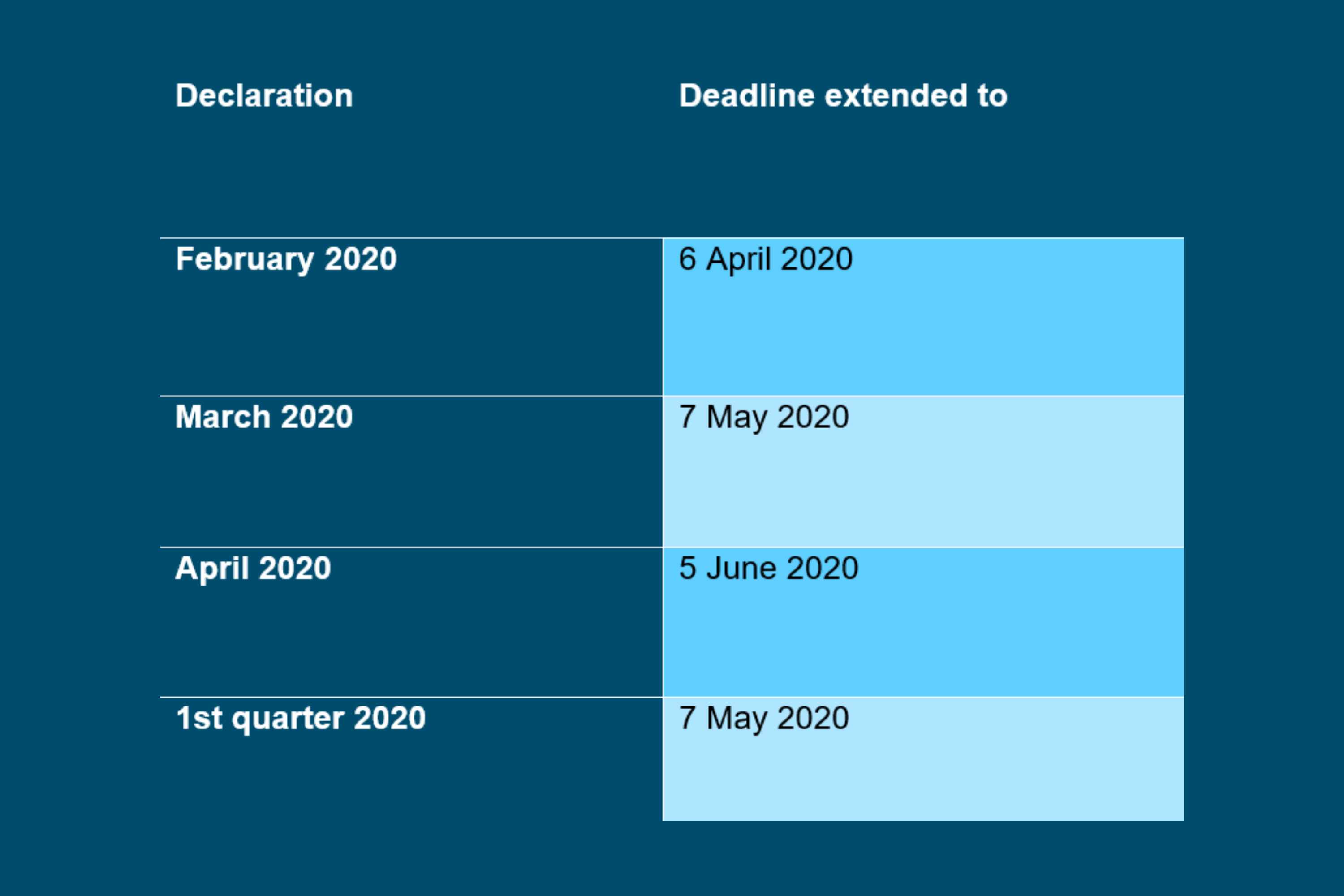

Periodic declarations

The submission of VAT returns for the month of March 2020 was postponed until 7 May 2020.

However, if you are entitled to a refund for a credit from the VAT return for the month of March 2020, you must submit your return no later than 3 May 2020. This refund can then be carried out within the normal period.

Nothing will change for the quarterly filers: if you file your return no later than 7 May 2020, the refund of the VAT credit remains guaranteed within the normal period.

The submission of VAT returns for the month of April 2020 was postponed until 5 June 2020.

However, if you have a monthly VAT refund authorisation (or are a starter), you must submit your VAT return no later than 24 May 2020 in order to receive the monthly refund on your account within the normal deadline.

Annual customer list

Deadline extended until 30th April 2020.

If you have ceased operating: at the latest by the end of the 4th month following the cessation of your activities subject to VAT.

3. New deadline for submission of declarations

New deadline for filing corporate income tax, legal entity tax and non-resident company tax returns for companies with balance sheet dates from 1 October 2019 to 30 December 2019 inclusive

The rules for filing declarations for companies with a balance sheet date from 1 October 2019 up to and including 30 December 2019 have been changed. The limit date will be calculated for these companies on the basis of the balance sheet date and therefore no longer on the basis of the date of the general meeting.

From the balance sheet date, they have 7 months to file their returns. This period runs from the first day of the month following the balance sheet date. If the deadline for filing is a Saturday, Sunday or public holiday, the next working day is the deadline.

For whom?

This applies to all companies, i.e. regardless of the filing method (online/paper) and regardless of the legal status (ordinary status/ dissolved companies).

What if the general meeting is adjourned?

As a result of the corona crisis, you can, under certain conditions, postpone the general meeting by a maximum of 10 weeks. If, as a result of these provisions, you are not in a position to file your declaration within the above-mentioned deadlines, you must request a postponement from your competent Management Team.

Balance sheet date before 1 October 2019

For companies with a balance sheet date prior to 1 October 2019, the existing rules continue to apply. The filing date is determined in function of the end date of the financial year and the month in which the statutory general meeting takes place.

If you have other questions regarding the Corona crisis, please visit our special FAQ

Last update: 07/05/2020