- What does it take to enhance your statistical forecast?

- How will structuring data help you plan demand at the right aggregated level?

- How do you engage your sales teams to improve S&OP?

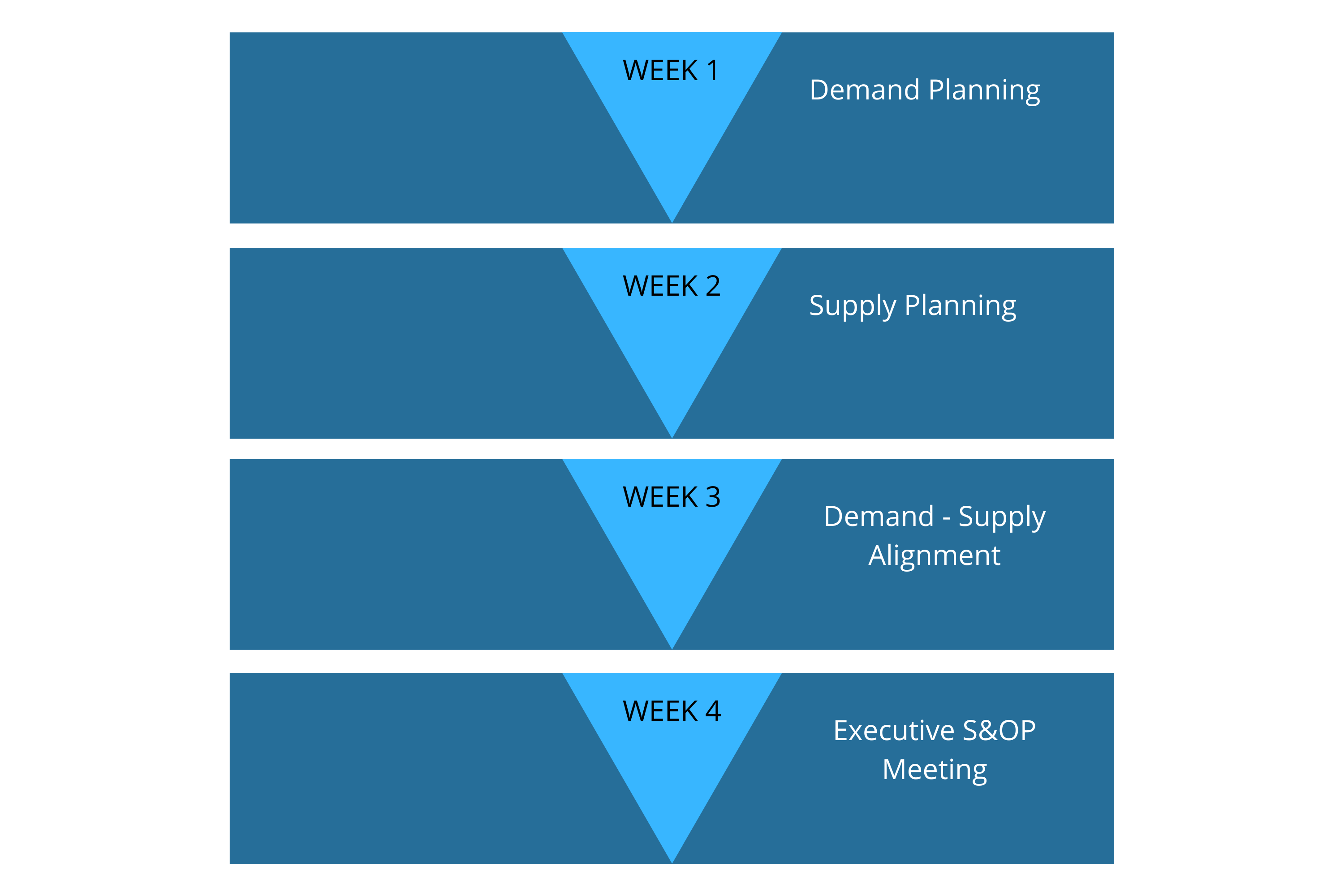

The APICS (1) Manufacturing Planning and Control (MPC) framework rightfully puts demand management in the spotlight, as it is key input to S&OP. In fact, Demand Management is the first step of S&OP. Many companies have now turned to S&OP to structurally and continuously align demand and supply and as such drive business. Stakes are high, overall profitability depends on it, and so many companies go through the typical series of monthly recurring S&OP meetings and analyses.

However, despite all of the effort and time invested, without a clear view on demand, S&OP will not get you an aligned business plan. If demand is not correct, your supply planners will lose trust and start ‘tweaking’ demand (usually purely based on historical data). So instead of running an S&OP process, you might end up running a push system and your team will fall back to firefighting and crisis management (like they did before you decided to implement S&OP). What this means, is that in order to be successful with S&OP, demand needs to be managed and worked upon.

Consider these 5 best practices to improve Demand Management:

1. Get the data right

A first, very valuable thing, to do, is to make sure that the data used for forecasting, is correct. So ensure historical demand records are accurate, bring structure into product hierarchies and sales organizations etc… Bringing structure into these data sets, is an indispensable step, as it will help you plan demand at the right level (see lower) and as such it will power your S&OP. Good data management will also give you insights into key questions, such as, what are the interactions between certain product families? What is true customer demand, not confusing stock refills with customer demand… Do you understand potential demand cannibalization, have promotions biased your data? All of these insights will come when you take control of the underlying data structures.

2. Enrich forecast with business insights and events

Providing a monthly sales forecast update, is simply is not enough. This is how it’s done more often than not: your sales and marketing managers come up up with a statistical forecast which they tweak a little by adding some insights they might have on what will happen in the marketplace.

This is how it should be done: salespeople need to be made accountable for bringing in as much valuable background information on demand. They should be brimming with questions – and, of course, answers. Are they closing a new major contract? Is your competitor launching a new product? How much additional sales is your new promotion campaign triggering? What is the impact of product pricing strategies, how is the market responding to your new packaging configurations? Demand forecasting needs to address these questions in detail, because these are the key elements that will improve forecast accuracy over time. And yes, it takes time to accurately quantify how the above examples influence demand. It’s a learning curve: over time sales managers will get better at it.

3. Segment demand in order to focus and prioritize

S&OP is about finding and keeping the right balance across your organization. That’s easier said than done, because it will require tough choices and sacrifices. Imagine a situation where demand for a given product family exceeds the volumes that manufacturing can commit to without making compromises. To address these types of problem statements, you need a clear prioritization approach, which favors rational data over sentiment and emotions. To do so, it is important that sales managers understand the details of demand and how it comes to exist. They need to have a clear eye on the relative value of each market segment, of each customer and how each product family contributes to overall company profit. There are a number of proven methods to segment demand and drive prioritization management (an integral part of successful S&OP). Apply these best practices to segment and prioritize demand, in order to facilitate your S&OP decision-taking.

4. Make the forecast level appropriate for the time horizon

S&OP covers a period of up to 18 and even 36 months. Be sure you don’t spend time forecasting at the Stock Keeping Unit (SKU) level for this horizon. Instead, do it at a more aggregated product family level and disaggregate to a more detailed product level, when you enter the Master Production Scheduling (MPS) horizon. It takes well-defined planning processes and an aligned understanding of these planning processes, to prevent that time and energy are spent by planning at inappropriate levels of detail for each time horizon. Again, the APICS MPC (see point 1) can bring insights here.

5. Bring in a Demand Manager

Convince your sales team that accurate forecasts are fundamental for good business. Show them that their input can be the flywheel that gets them better product availability and that it will improve service to their customers. Also, good forecasts prevent that supply capacity is used for the wrong materials at the wrong time or place. However, with larger sales teams, you might want to assign a Demand Manager, who is there to collect inputs and streamline their integration into the monthly S&OP cadence. This person will collect demand updates, translate these into actions and keep your sales managers motivated by reporting on the benefits of the information they provide. Mind you, sales managers will remain responsible for providing good input, but the Demand Manager is there for motivation, continuation and translating all insights into the Demand Plan in a structured way.

- APICS (American Production and Inventory Control Society) founded in 1953, is acknowledged around the globe and across all industry sectors as the thought-leading organization for supply chain best practices. APICS is also known for its training and certification programs on supply chain management (e.g. CPIM-Certified in Production and Inventory Management) Today, over 45,000 certified people across the globe are part of the APICS community.