Contact one of our experts

What will the revised registration fee look like from 2022?

The Flemish government has revised the regulations regarding registration duties. From now on, anyone who buys their only home will only pay registration fees of 3%. From this year, people who buy a second home will pay registration duties of 12% as the standard rate.

Although the entry into force of this revision is planned as of 2022, it still needs to be approved by the Flemish Parliament.

A little less and a little more

The standard rate of registration duties payable on the purchase of a home in Flanders, also known as the right of sale, has been 10% for several years, compared to 12.5% in Wallonia and Brussels. Many families enjoy a preferential rate when buying their first home, however, and this has become even more advantageous following the Flemish revision of the regulations. This has been compensated by an increase of the standard rate to 12%.

Reduction of registration fees for the purchase of your only home

Sole family home

The rate of registration fees for the purchase of the sole family home drops from 6% to 3%. The conditions for this favourable arrangement remain the same. Let us briefly summarise them:

- The purchase must be made by a natural person.

- It must be a pure sale; an exchange or transfer from a company does not qualify.

- Full and complete ownership must be purchased. An undivided share or the purchase of only the usufruct or bare ownership do not qualify, although there are exceptions.

- It must be a residence; building plots are excluded.

- The buyer of the property must not own any other property or building land.

- You must be registered at the address of the property within 3 years after the purchase.

Short-term sales

If you have already bought your new home, and your current home is sold within a short period of time, you can immediately benefit from the reduced rate. This short term was 1 year, but has been raised to 2 years as of 2022.

Major energy renovation

In the case of a home that needs major energy renovation or reconstruction, the rate will drop even further from 2022: from 5% to 1%. The conditions for this favourable arrangement remain the same. You must achieve an E-level, a score that indicates the energy-efficiency of a building, of no more than E60, however. And you also have to remain domiciled in the house for 6 years, instead of 5 years.

Modest home

If you buy a sole modest home, you will receive an additional discount on the registration fee that is due. A home is 'modest' if the purchase price is below a certain limit. Until recently, this was a maximum price of EUR 220,000 for homes in core cities, and EUR 200,000 for homes in other municipalities. From 2022, this limit has now been increased by EUR 20,000, and amounts to EUR 240,000 for homes in the core cities and EUR 220,000 for homes in other municipalities. This reduction in the registration fee is adjusted proportionally to the new rate. For example, the registration fee is reduced from EUR 5,600 to EUR 2,800 for the purchase of a sole 'modest' house of one's own. For the purchase of a sole 'modest' dwelling of one's own with an energy renovation, the registration fee is reduced from EUR 4,800 to EUR 960. This amounts to an exemption from registration tax on the first writing of EUR 93,333.

Date of authentic instrument

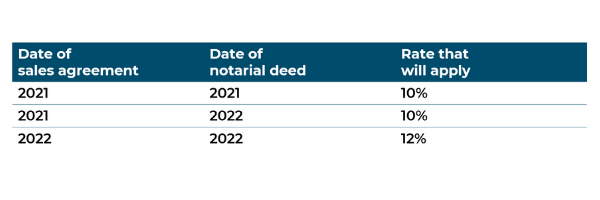

These changes apply to authentic deeds of purchase that are executed as of 1 January 2022. This deviates from the principle that the sales duty or registration fee is already due from the date of the sales agreement or compromise. You must submit such an agreement for registration within 4 months.

The date of the notarial deed therefore determines whether the 6% or 3% rate should apply. Even if the sales agreement was signed in 2021, but the notarial deed was not executed until 2022, the 3% rate will apply.

Be careful with a so-called ‘mutual promise to buy/sell’. A promise of this kind is not usually considered to be a sales agreement that makes the registration fee payable.

Increase in registration fees for the purchase of property other than sole residence

Other real estate purchases

In the case of real estate purchases other than the purchase of the sole family home, the standard rate of registration fees increases from 10% to 12%. This relates to the purchase of a second home, a building plot, non-residential property, etc.

An exception is provided for the purchase of agricultural land and nature reserves, where the 10% rate is retained. The rate of 4% also remains applicable for the purchase of real estate by a professional seller.

Date of the sales agreement

The higher standard rate of 12% applies to purchases for which the sales agreement or compromise is concluded from 1 January 2022 onwards.

The date of the sales agreement thereby determines whether the 10% or 12% rate applies. The 12% rate only applies if this date is in 2022. Sales agreements concluded in 2021 for which the deed is not executed until 2022 therefore still fall under the old rate of 10%. Here too, one must be careful with mutual promises to buy/sell, as these are probably not considered to be sales agreements. If you conclude such a mutual promise in 2021, you may still have to pay 12%.

Portability of registration fees to disappear in time

Many families first buy a small house or flat, and then trade it in for a larger one after a few years. Under certain conditions, previously paid registration fees can be deducted, up to a maximum of €13,000. This system of 'portability' will be phased out from 1 January 2023, and completely abolished on 1 January 2024.

In the case of a property that you purchase no later than 31 December 2023 and where you purchased the previous property before 1 January 2022, you must make a choice:

- You can either opt for the application of portability in combination with the old rates of registration fees (6% and 5%);

- Or you give up the portability, but benefit from the new rates of registration fees (3% and 1%).

Here, too, the date of the authentic instrument applies.

If you would like more information on these new rates of registration fees in Flanders, please do not hesitate to contact our team.