The health crisis and the resulting lockdowns placed a heavy burden on the global logistics networks that carry today's global economy.

The participants are all Supply Chain experts and their joint experience covers the broad Supply Chain field: from Purchasing and Planning to Production, Quality, Warehousing and Transport. Almost all industry branches and sectors are represented in the survey.

The results confirm what everyone suspects: COVID-19 is more than a stress test for logistics networks. The impact of the pandemic on Supply Chain & Operations is huge and, according to this research, a number of processes will also fundamentally change. In this article, we share some of the most remarkable findings.

A first concern: monitoring stock levels

In addition to protecting the people in the workplace, monitoring stock levels was also a major primary concern of Supply Chain managers in the different sectors.

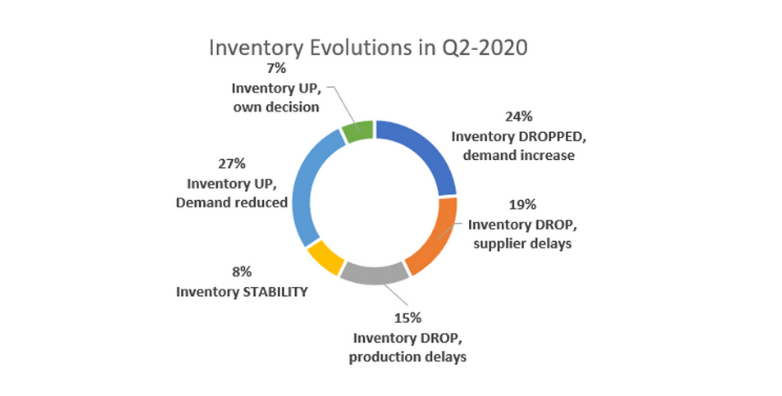

Inventories: 75% indicate that stock levels of components and major finished products were decreasing to some extent. The reasons for this are twofold: on the one hand, the demand for a number of basic products increased sharply (mainly due to the bullwhip effect and panic buying, and not so much to increased demand from the end customer), but on the other hand, many supply problems were also noted. For several weeks the air cargo capacity had been greatly reduced, and maritime transport and even road transport were also severely impacted by lockdowns.

About 20% indicate that stock levels increased rather because of the lack of or a strong decrease in customer orders.

72% indicate that the Inventory Management Policies will be adjusted, or have already been adjusted because of COVID-19. As you can see, if that had not yet been the case before the crisis, inventory management is really at the top of the agenda today.

How heavily was production impacted?

Supplies from the Far East already started to sputter in January and February, but the actual lockdowns in Europe and the US impacted production on those continents even more heavily. This is clearly reflected by the figures: no less than 73% indicate that, during March-April-May, they reduced production volumes because of the consequences of COVID-19.

The Supply Network Configuration will be examined and strategic choices will be made.

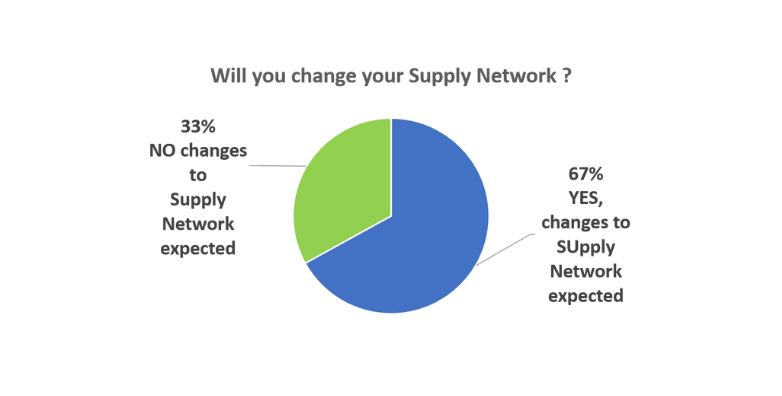

Since the Coronavirus outbreak, there has been a lot of talk about the relocation of certain key activities in the production chain. But in fact, ideas about this have been circulating for much longer, inspired by trends that already emerged before the pandemic and that question the current linear global logistics network: from imminent trade wars and security concerns to product quality standards, climate goals and the new opportunities that Industry4.0 holds...

Was the logistical challenge brought by COVID-19 the proverbial last straw? In other words: will companies really start to tinker with the configuration of their Supply Network, and will relocations take place? Yes, they will. Our survey shows that no less than a staggering 71% indicate that they expect that their company will adjust the Supply Network in order to be better equipped against future disruptions. Almost 20% predict that this reconfiguration will be very significant, that new investments in manufacturing facilities might shift geographically, indicating that some critical steps in the manufacturing process might ‘come back’ to the West, as a measure to be more resilient to future shocks.

Digital integration with suppliers will be crucial

In recent years it has already become apparent how new evolutions in digital technology find their application in numerous Supply Chain processes. COVID-19 has shown that companies that have a detailed view of the stocks throughout their Supply Chain eco-system from suppliers and distributors have a real competitive advantage. They had a faster overview of the situation, they were much more agile and decisive to face the crisis.

With the use of digital technology, leaders are developing Supply Chain reports and control towers that provide visibility on the inventory levels in the Value Chain: connecting data from internal systems, but also tapping into data sources from key-suppliers, key-customers and logistics partners. As such creating an end-to-end, real-time view on the Supplies in the global network. We asked the participants where they stand today with regard to digital integration with their key suppliers.

Only 30% report that they are now highly integrated with their main suppliers: they have (almost) real-time data exchanges about orders and integration with ERP-systems. The vast majority of companies show that they exchange data more ad hoc and are still a long way from actual structural integration and exchange of key data with the main suppliers. It is clear that there is an important opportunity here, great potential to better arm ourselves against future calamities. Incidentally, improved visibility also offers the opportunity to work more efficiently in ‘normal’ circumstances, to use resources better and to keep more control over the flow of goods. Apparently, that has rung a bell, because when we asked who is busy setting up better logistics reports today, no less than 64% said they recently quickly rolled out such reports (or that they will roll them out within the next few months).

Flexible workforce solutions are needed to bridge work load peak

We have noticed in the past months, and certainly during and right after the lockdown, that a lot of operational firefighting was needed on a daily basis. Customers who delayed orders, suppliers who could not meet timelines, production schedules that could not be kept. There were many reasons why the workload on logistics planners seemed to increase as a result of the COVID-19 crisis.

When we polled survey participants on this particular point, as many as 81% indicated that work volume has increased for those in planning positions or with a broader coordinating role.

Although sales were negatively impacted by COVID-19 in many companies, especially in the first quarter of the lockdown, participants reported that the workload on Supply Chain planning teams had increased substantially. On the other hand, only 20% indicate that their organization is effectively recruiting or expecting to recruit in the first 3 months... In other words, despite the increased workload (more coordination, more firefighting , rescheduling, etc.), most organizations are very cautious and cannot (or do not want to) hire additional staff to support the extra volume of work (especially in planning) that arose during the first COVID-19 wave.

It will be important to further monitor this in the second half of the year, because increased workload cannot be sustained by the organization for a longer period of time without having consequences.

To be continued

Our fascinating research brings up a number of to-the-point findings and trends. We are experiencing unprecedented times, and the Supply Chain world in particular will be further tested in the coming quarters for the resilience of systems, processes and organization. We will continue to monitor it and will certainly follow up on this research, which can serve as a barometer for our profession. Keep safe & stay healthy!

If you would like to receive the full white paper, please contact Joël Wijns.

Contact one of our experts