So why carry out this research now?Over the past two years, many disruptions in the Supply Chain have made global headlines: the ‘COVID stop & go’, empty store shelves due to supply problems, the delay in the Suez Canal, the logistics hiccups caused by Brexit, and the worldwide shortage of logistics personnel. But there’s more going on with global trade and logistics networks. Just think of the persistently high cost of energy, geopolitical threats such as the West’s tense relations with China and Russia, and the need for a new approach to climate change, through, for example, the European Green Deal. It’s clear that global logistics chains are under increasing pressure.

Persistent global logistics congestion

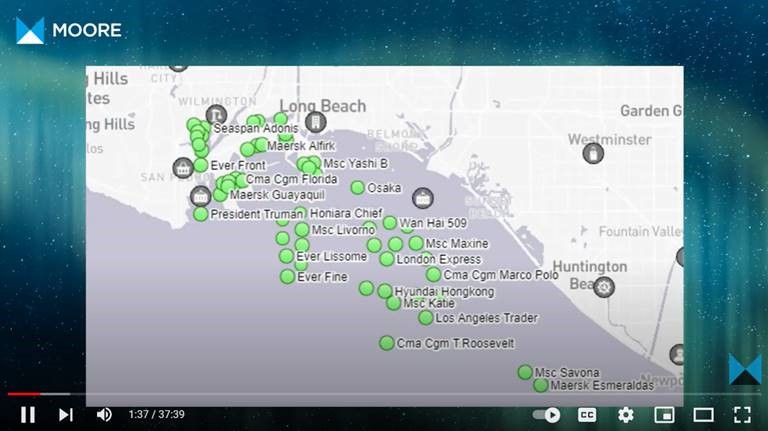

What’s next? At Moore, we were wondering the same thing. On December 8 of last year, a panel of Moore Global specialists discussed the logistics implications of successive disruptions to global trade over the past two years. Mark Fagan, Moore Industry Leader Manufacturing & Distribution, used satellite images to demonstrate the extent of cargo vessel congestion. The images showed a three-week-long queue of container ships waiting to dock at the Port of Los Angeles, California. It was a race against time to get store shelves filled by the end of the year. The same phenomenon occurred in other major ports around the world. As early as the summer of 2021, production lines in various sectors had been shut down, from chemical production to the automotive industry.

Aerial view of the Port of Los Angeles, where cargo vessels have been waiting up to three weeks to enter the port to load and unload. The congestion is due to the cumulative backlog caused by a chain reaction of events that have disrupted global Supply Chains over the past two years.

Container shipping under pressure

Costas Constantinou, Moore Industry Leader Maritime, is an expert in maritime logistics and closely follows the container market. He explains that for a very long time there was overcapacity. As a result, prices had remained low for more than a decade. For several years, this had put the brakes on investment in the container world.

So shipowners were surprised by the unprecedented and sustained increase in demand for container shipping. For a year and a half, prices for container shipping have remained at a level up to eight times higher than before the pandemic. And they’re not expected to ever fall back to 2019 levels, in part because of increasingly stringent climate regulations. Moreover, not only will it remain more expensive than before to bring a container from Shanghai to Europe or Los Angeles, the journey will also take longer. To emit less CO2, ships are already sailing a few knots slower today than they did a few years ago. This increases lead time and average inventory in transit.

Temporary rush on inventory? Or is there more to it?

All of this has changed the way inventory is viewed. Empty store shelves and months-long delays have meant that companies that manage to get hold of the parts they need have a significant competitive advantage over those that don’t.

As a result, many industries have started to stockpile raw materials, parts, and semi-manufactured products. Ross Baccarella, CEO of BTX Global Logistics and a participant in the roundtable, explains how demand for warehousing and storage space in the US exploded by mid-2021. According to Baccarella, this is confirmation of the fact that inventory is being strategically increased in many sectors. Whether that’s an enduring phenomenon remains to be seen. But we do get the sense that structural changes in global Supply Chain networks are imminent. We feel that the current rush on inventory is a precursor to a deeper search for more structural Supply Chain stability — a quest for greater Supply Chain resilience, in other words.

Take part in the Supply Chain resilience study

With our new survey, we want to find out to what extent our feelings are justified. Based on the findings we’ll map out the structural changes (or lack of them) in logistics networks and the strategic (re)organization of supply. In this way, we’ll arrive at a better understanding of how Supply Chain leaders are dealing with the changes and reacting to the uncertainties of these turbulent times.

We’d love your company to participate in this research. Contact us for more information. You’ll be in with a chance to win a free APICS CPIM training course, so don’t miss out on this opportunity!

Contact one of our experts